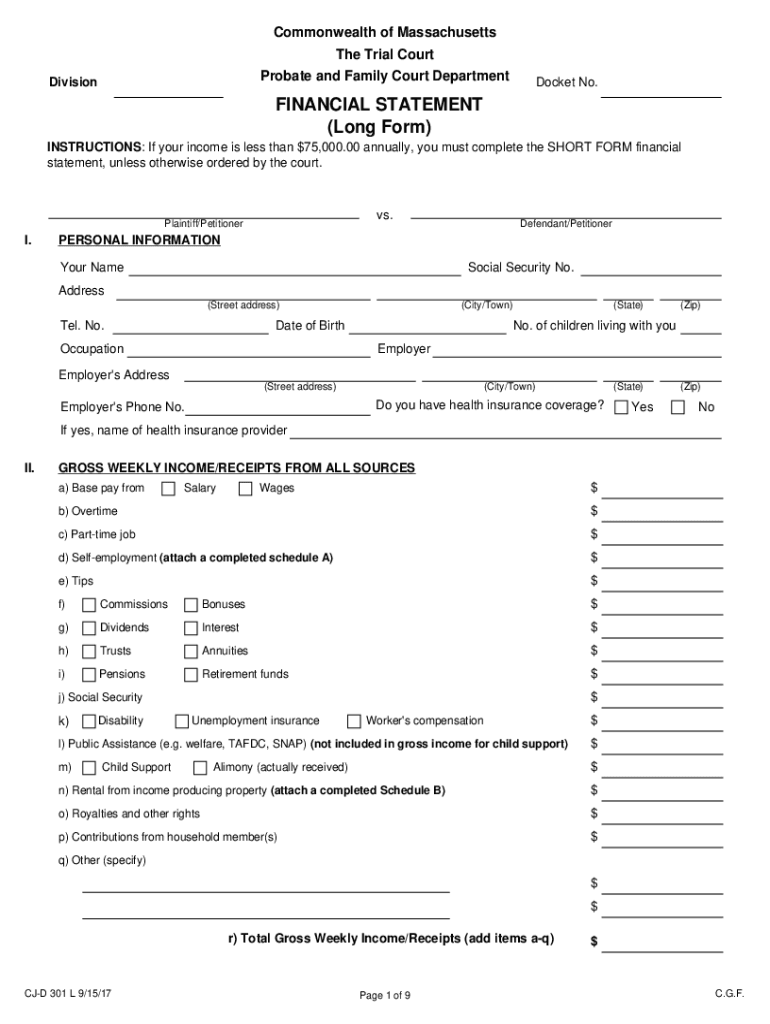

Who needs a Long Financial statement form?

If you need to deal with the Family Court on a case of divorce, separate support, paternity, modification or contempt and your yearly income is more than $75,000, you have to fill out this financial statement.

What is Long Financial statement form for?

This form is used at the court hearings concerning alimony, child support, property division, and other financial matters. The financial statement is one of the most important documents you file with the court. The information in this document helps the judge to make an important decision.

Is Long Financial statement form accompanied by other forms?

You must attach the copies of last year’s W-2 and 1099 forms.

When is Long Financial statement form due?

Each party of the case has to complete the Financial Statement within 45 days after the defendant receives the complaint.

How do I fill out Long Financial statement form?

You have to fill out the form completely and truthfully. Keep in mind that untrue answers can lead to criminal prosecution. While completing the form, you have to provide the following information:

-

Personal information

-

Information about your income and deductions

In the end, you have to sign and date your form.